So I’ve recently had my eyes opened to the world of Finance (as we all know the infamous Baz was a successful financial adviser before beginning The Social Adviser). I found this book under the stairs here at the Launchpad a couple weeks after I started, and thought it was the perfect time to brush up on some of my non-existent knowledge of the financial world (which I still know very little about!)

Carl, like Baz decided to make a change from straight-up financial advising toward public speaking, with an emphasis on changing un-useful behaviour patterns. As you can pretty much gather from the title, this is what The Behaviour Gap is more or less about, the gap between useful and unuseful behaviours with money.

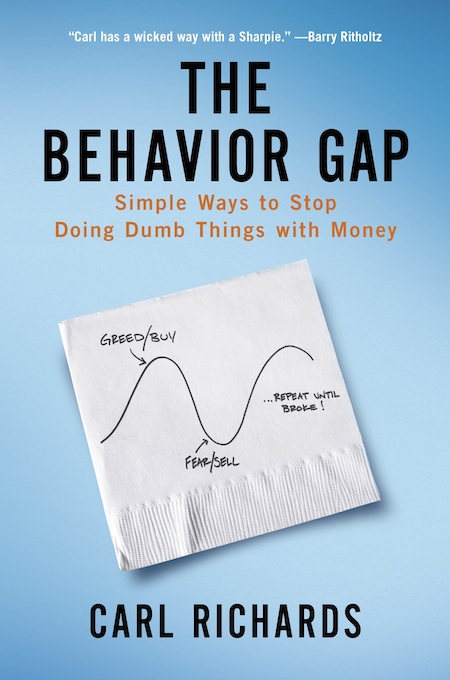

For a lay(wo)man like me who is just surpassing her mid twenties and never even considered using a financial planner, it was a very interesting read. I do feel that things got a little repetitive, even for me, but I can understand the need to give different examples to really drive ideas home for a range of different individuals. Some of the colloquial scribbles/diagrams Richards uses seemed like page fillers but others were quite useful as a simplistic visual representation of his ideas. I definitely enjoyed his informal tone and large spacing which converted his otherwise dry content into more of an inviting and relatable conversation.

I guess the best way to approach this review is to look at exactly what I have taken away from this read… but before I go on I want to again clarify the perspective I write this from, as many of you have quite possibly had these realisations long back. However, maybe my perspective can help you to inform your young adult children or your clients, as I can be fairly confident that the average twenty something won’t have spent much time planning their financial future, nor are we always particularly receptive to our parents’ advice!

What I learnt:

1. To choose your adviser carefully.

- Just like you would with your doctor, mechanic or child carer – put some time into finding the right planner who understands and cares about you and your needs. Just because a ‘Financial Planner’ plaque hangs on their office door, does not immediately qualify them to share your vision and ensure your financial security.

2. Your financial goals should directly reflect your life goals

- Define what it is you want to achieve in your lifetime. If that’s thinking too far ahead, then try for at least your 5-10 year plan. For me, this meant taking the fear out of my future plans. Changing my thinking from ‘I’ll never be able to achieve that, where would I even start’ to ‘what do I really want and how am I going to get myself there’.

3. Stick with your plan!!

- Now the idea of having a ‘portfolio’ is still way off in the distance for me at the moment. In fact I’ve even used ‘diversifying my bonds’ as a joke reply to ‘what are you up to this weekend’. However, if and when I do, Carl has firmly implanted in my brain that following trends and making decisions based on emotion rather that logic are UNUSEFUL behaviours! Sticking to your long term plan and logic is the best bet for seeing your goals come to fruition.

So to summarise, I think this book does a great job of breaking down some intimidating ideas into digestible conversation. The book may not have changed my life, but it has certainly pointed me in a more responsible and considerate direction in terms of planning my financial future. I would recommend it especially to those in the transitional phase of their twenties!

By Dani Aston