As published in Financial Planning Magazine (29th January 2014)

What does all of this interconnection, technology, bombardment of information and sharing of content mean for business and more specifically, those of us who provide advice?

It’s simple:

1. The escalation of information and content distribution makes decision making via ‘knowledge intake’ harder, not easier;

2. The interconnectivity of relationships makes decision-making by emotion easier.

So the question is, do you want to be harder to do business with or easier?

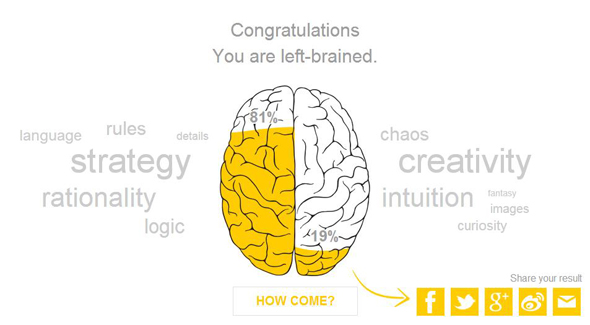

I can almost hear the left brain analytical financial planners reading this cringing at the thought of emotional decision-making. But ‘chillax’ and let me bring the rational facts back to the table for you to analyse. Before I do, I thought you should know that in all of the mental assessment tests I have taken, I am about as left brained as is humanly possible.

What you need to understand is that emotions are the translation of data from the limbic brain (the decision-making centre of our brains). That data is the sum of our perceptions and experiences packed into an instant, to provide us with the context for all of our decisions.

The problem with emotional decision-making should be obvious to you; after all, you are reading this article in a magazine all about financial planning!

Using emotions to make decisions about your business, career, investments, cash flow or money is almost always bad.

So, as planners, our job is to rationalise financial decision-making, and to get our clients to do the same by putting everything into rational explanations and process, right? Well, that’s one way to do it, but it is also working against the brains of our clients, is inefficient and significantly less profitable for both parties than my suggested alternative.

Whether you like it or not, your clients are making decisions about the advice you give based on emotion, and the job of great planners is not to rationalise the decisions of clients but to use rational thinking to contextualise the emotions of their clients.

Simply put, the value planners provide in the decision-making centres of clients’ brains has nothing to do with tax, investment returns, diversification or any other benefit we might throw at them. Removal of stress, security, increased personal relationships, hope, freedom; these are all examples of the real value we provide clients and in the language that our emotional decision-making centres can truly understand.

For most of my 15 year career as a financial planner, if a person spoke with me about money they became a client; it was just as simple as that. I almost never had discussions about fees, apart from how much and how to pay, and this was simply because I learned early to translate complex planning into the emotional context of the individual client.

So you might say, what does this have to do with social and digital media? Well, let me ask you this: If I can get you to agree that it makes sense to translate advice into emotional relevance for a client, then wouldn’t it also make sense to translate the decision of who to take advice from into the same emotional context?

Yet, what have we all been doing for so long when promoting ourselves? Simply put, the exact opposite! Human brains and emotions, whilst being poorly designed for financial decision-making, are exceptionally designed for making decisions about other people. We are hard-wired to be social creatures and it is the principal reason, in my opinion, for our success as a species.

Yet as professionals, we have done everything in our power to make it hard for prospective clients to see the real people behind the professional mask, and because of this, we have marginalised the profession of financial planning, making it feel impersonal, risky and untrustworthy in the public mind.

If you are still with me, congratulations. What comes next may very well keep you up tonight with excitement because all of this is creating ‘the perfect storm’ for those advice professionals willing to think a little differently.

In essence, the ‘socialisation of business’ means this: people are frustrated with the amount of white noise in their lives. They are sick of being pitched at and marketed to. Life is getting busier and the amount of information needed to make rational decisions is growing exponentially.

Social business is not about marketing via social media; it’s about understanding that people want to make decisions first about who they do business with. Our brains are hard-wired to draw us to those we relate to, understand and who share the same values as we do, and social media is building the engine room to empower those businesses that understand that caring, relationships and values are the new competitive advantage.

At a time when the demand and need for advice is going to grow exponentially, we now have the tools to leverage the most important asset the financial planning profession has ever had – you.

Stop trying to market and explain what you do. Decide who you are, what you stand for and why you do what you do, then use social media to showcase the real people in your business to the world. Make it easy for your prospective clients to make decisions about who they want to do business with and your ideal clients will come to you.

Want to ask me questions or debate my logic? Come and join the conversation on my LinkedIn.